AURO.ai

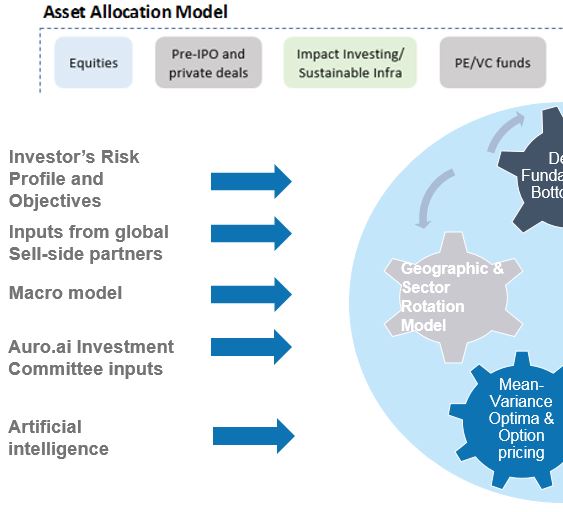

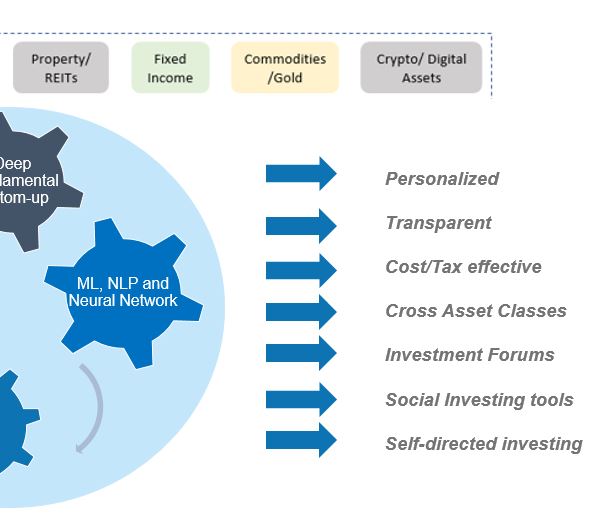

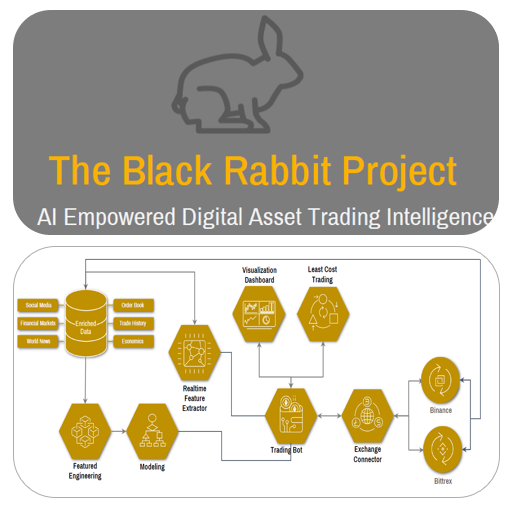

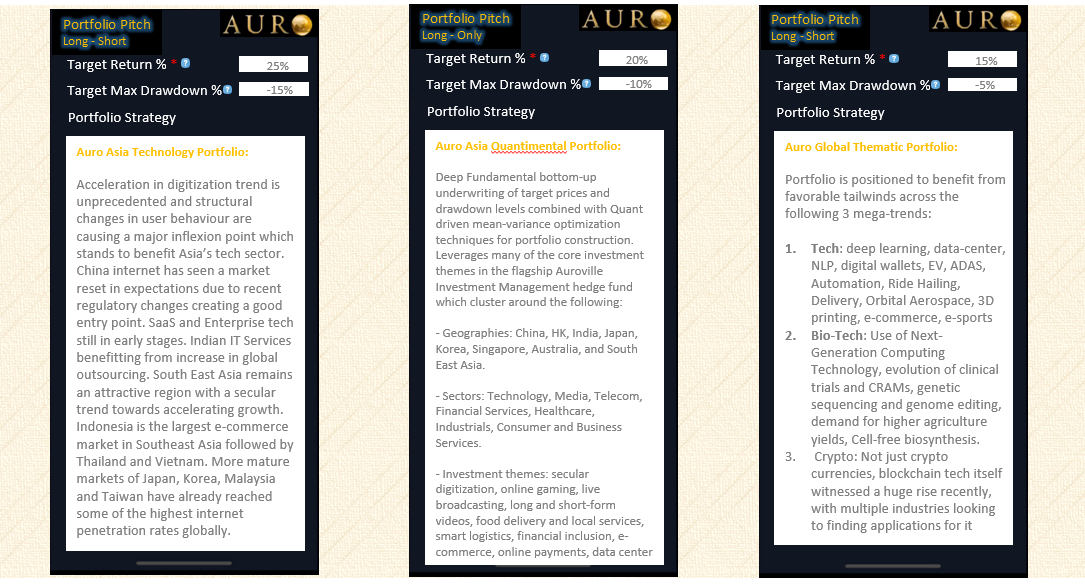

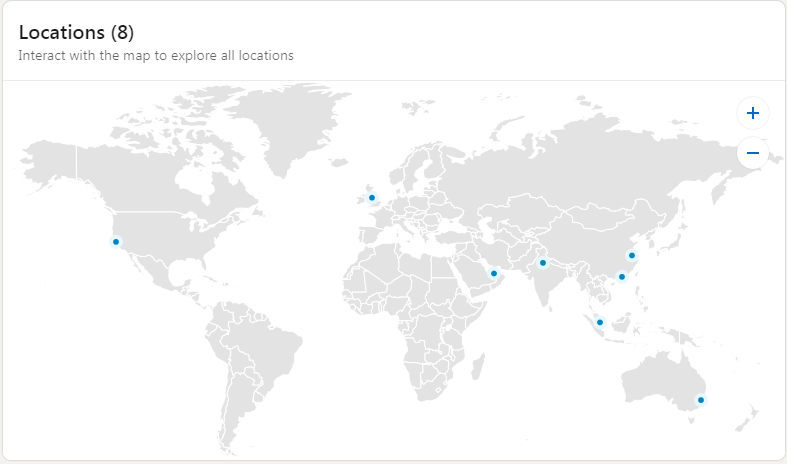

An Artificial Intelligence centric incubator. Joint-venture with Tatras Data, a global lab-based Data Science as a Service (DSaaS) company with offices in USA and India. AURO.ai leverages the domain expertise of its partners in machine/deep learning and neural networks and years of investing in the field of IT Services, Internet and Software, and global networks in the East and the West across the buyside and the sellside, to disrupt areas like FinTech, Blockchain, EdTech, HealthTech etc. If you'd like to learn more about any of our AI ventures or get involved, please send an email with a brief cover letter to ai@AuroIM.com